News & Views: The Currency Effect on Publishing

This month we look at how currency exchange rates may skew our understanding of the value of publishing activities. Are “currency effects” just a technical detail in the financial results of large corporates? Or do they profoundly affect even small organizations?

Background

When big corporates present their financial results, they often cite a secondary set of results “if currency effects are excluded.” Typically, this shows how different their financial growth would be if currency exchange rates did not change over time. In our Market Sizing Update last month, for example, we noted that, if we excluded currency effects, the value of the scholarly journals market would go from barely growing at all to keeping up with long term trends – an 8x increase.

In our October 2023 Market Sizing Update webinar we discussed whether currency effects are a technicality. They are not a usual part of most people’s day-to-day tasks and are – to a cynic – perhaps even an excuse for underperformance.

However, even smaller publishers rely on global submissions and global operations. Exchange rates are therefore an unavoidable environmental factor for many organizations. If changes in rates are significant, then they may skew measures of the organizations’ performance.

Lost in translation

Currency effects quantify the impact of changes in exchange rates on various aspects of financial transactions.

“Translation currency effects” relate to the conversion of financial statements from one currency to another. They most obviously affect multinational organizations, which typically maintain financial records in the local currencies of their regional operations. When these records are consolidated into the organization’s central reporting currency (usually its home currency), fluctuations in exchange rates can affect the reported financial results. The same local numbers may translate to different central numbers depending on the exchange rates in place when the calculations were performed.

This same principle affects our market sizing calculations, for which we must convert multiple currencies into one. Normally, analysts calculate each year’s numbers based on each year’s average exchange rates. We can then calculate the growth (change in total value) each year which includes any fluctuations in rates. But would controlling for exchange rate fluctuations make a difference?

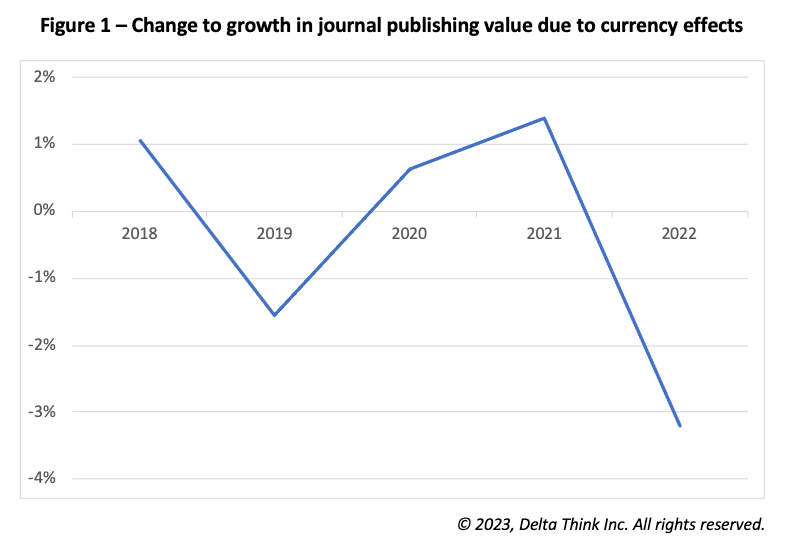

The figure above analyses the annual growth in the total value of the scholarly journals market. It shows the percentage point change in annual growth due to fluctuations in exchange rates. For example, in 2018, currency effects boosted the market growth by just over 1 percentage point.

We estimate the long-term average growth of the market is 2%-4%, so these changes are profound. In 2022, foreign exchange (FX) rates reduced the market from a healthy growth rate to flatlining.

Transactions and globalization

Currency effects are not limited to financial reporting. More or less money may change hands for the same transaction depending on prevailing rates. Even small publishers may sell into several countries, spanning perhaps 10 or more different currencies – the DOAJ has APCs listed in over 40 currencies, for example – so these transactional effects are widespread.

Where publishers fix their prices in one currency, the costs of fluctuations are born by their customers. Costs to libraries, consortia, and universities are at the mercy of exchange rates. (We explored this further in our analysis of affordable pricing.)

Where publishers offer prices in several currencies – as many do – they are taking a bet that exchange rates won’t change too adversely through the year that the prices set remain in effect. The timeframe may be longer for multi-year deals.

The degree to which publishers are exposed to currency effects will depend on the proportion of their activities conducted outside their home country.

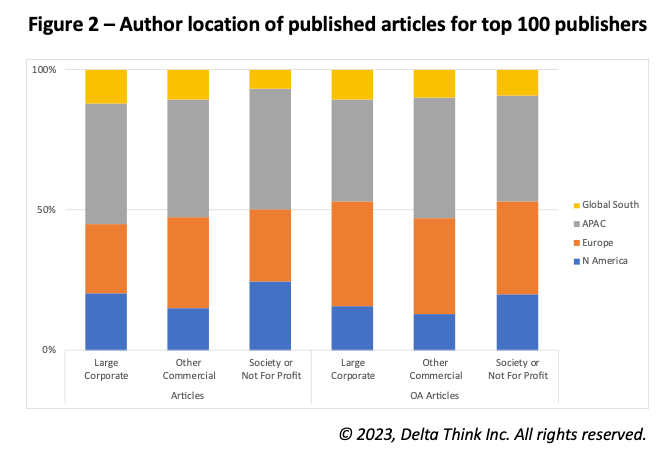

The figure above analyses where published articles come from, based on the location of authors’ affiliated institutions. The sample covers the top 100 publishers by total volume of output in 2022. The three bars on the right cover open access (OA) publication output. As OA publishing often charges per article published, the output translates directly to revenue and indicates exposure to transactional currency effects.

The chart shows to what degree authorship is global. A large corporate located in the US, for example, might find that a significant majority of its publications come from non-US authors. But so too might a smaller commercial publisher or a society publisher. The narrowing of the small sample to the largest publishers excludes small organizations that are more likely to be highly localized. Highly globalized operations appear to be commonplace.

Subscriptions revenue is harder to quantify, as authorship may not necessarily translate to higher subscription revenues. However, the bars on the left, which show all output, give a useful context.

Conclusion

Currency effects are not simply a technical issue buried in the big corporates’ annual reports. They profoundly affect the performance of even modestly sized organizations and our ability to measure it.

If exchange rates changed slowly, then they would have little effect beyond modest price changes. However, in recent years we have seen exchange rates swing significantly – particularly in the wake of systemic problems such as COVID-19. We saw swings of over 10% between 2021 and 2022 in some cases, which significantly outweigh the changes of a few percent in costs or income that are typical in our industry. An organization might grow at a spectacular 10%, only to see its performance wiped out if exchange rates swing the wrong way. Even the high growth rates of open access revenue are affected.

The scale of currency effects would mean little if organisations operated within national boundaries. But in our highly globalized industry, they don’t. Research is a global endeavour – and so even small organizations are exposed to fickle exchange rates. Small publishers operate in a global ecosystem; many engage the services of large publishers. Cost bases may be exposed as so much of publishing operations are offshored. Even the safe haven of fixing prices in a local currency, and letting the buyer take the risk, is under threat, as we see increasing discussions about setting prices to reflect local affordability.

In years of volatility, we need to control for currency effects in our reporting. Otherwise, the underlying health of an organization – or of our ecosystem – may be obscured by environmental factors outside its control. We also need to understand these effects so we can plan for risks ahead.

Perhaps those technicalities in financial reports matter after all.

The analysis here is an illustration of what we can look into. For those interested in understanding the specifics for their organization, please get in touch.

This article is © 2023 Delta Think, Inc. It is published under a Creative Commons Attribution-NonCommercial 4.0 International License. Please do get in touch if you want to use it in other contexts – we’re usually pretty accommodating.