News & Views: Market Sizing Update 2023

Overview

Each year, Delta Think's Market Sizing analyzes the value of the OA scholarly journals market. This is the revenue generated by providers or the costs incurred by buyers of content.

We estimate the OA segment of the market to have grown to just over $2bn in 2022. This is strong growth over the previous year, although it is significantly lower than the year before. The overall scholarly journals market showed very little growth during the same period.

The headlines suggest that we may be seeing the beginnings of a correction to long-term trends after two years of exceptional growth in the wake of COVID-19. However, reductions in growth rates are exaggerated by currency effects.

It is too soon to know exactly when we may see a return to long-term trends. Our models currently suggest a further correction through 2023 and possibly 2024.

Headline findings

Our models suggest the following headlines for open access market sizing:

We estimate that the OA market grew to just over $2bn in 2022.

- 2022’s OA market grew by a little over 24% from 2021. This is around two thirds of the growth we saw in 2021.

- We estimate the total scholarly journals market to have increased by 0.4% in 2022, compared with its long-term low single-digit growth of 2%-4%.

- Given the exceptionally high growth in 2020 and 2021, a correction in 2022 was expected. We saw this in the whole market. It is less obvious in the OA segment as its growth remains strong; however, OA’s growth was significantly lower than it had been previously.

- Growth in hybrid revenues was a major factor driving growth in OA, although all types of OA saw improved revenues per article, which helped to drive growth.

- Currency effects contributed to reduced growth. Many publishers operate in non-USD currencies, which lost value against the US dollar in 2022. If we exclude currency changes, the OA market would have grown by over 29% (an additional 5 points) in 2022, and the overall journals market would have grown at 3.6% (around 8x its headline growth). This suggests that underlying growth in the OA market has slowed slightly, and that of the overall market is growing in line with long-term trends.

- Growth in OA remains significantly above that of the underlying scholarly journals market.

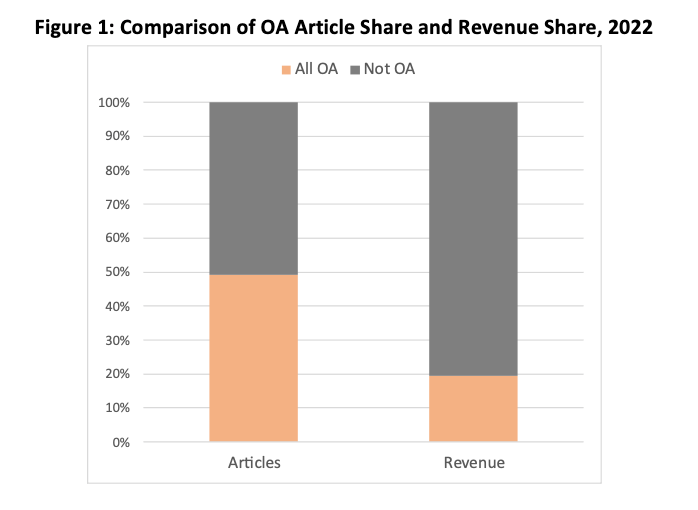

- Just over 49% of all scholarly articles were published as paid-for open access in 2022, accounting for just under 20% of the total journal publishing market value.

- We anticipate a 2022-2025 CAGR (average growth each year) of 13% in OA output and 13% in OA market value.

A note about our method

As ever, we are very grateful to the organizations that participate in our annual survey, which we anonymize and aggregate to inform our estimates. We will be sending out our usual detailed market update and analysis to participants shortly.

Our market estimates focus on research publications for which money is likely to be paid, either to read or to publish. We focus on underlying trends to inform strategic decision-making. Open Access in this context excludes “Bronze” (public access) and Green OA. Each year our data improves, so we restate figures as needed to keep them up to date1.

Trends

We have seen a slow-down in growth in 2022, although underlying drivers of the market remain strong.

- COVID-19 led to a significant increase in publishing activity, showing above-average volumes and growth rates in 2020 and 2021.

- Last year, results from our survey and anecdotal feedback gave mixed messages about the outlook for 2022. Low growth in 2022 was expected by many, as things corrected towards underlying trends. 2022 did show markedly lower growth compared with the previous year. However, as the underlying growth of OA remains strong, 2022’s lower growth numbers seem high when taken in isolation.

- Our anecdotal evidence and our publisher survey lead us to expect a further slowing of growth in 2023, as activities normalize back to underlying trends through 2023 and 2024. It is too soon to say by exactly how much and when this will happen.

- Slowing growth in OA output contributed to its reduced growth. Fully OA output grew at around half the rate of hybrid output. However, growth in OA revenues was greater than growth in output. This suggests that OA “yields” – revenues per article – improved. Hybrid showed the best performance – its value grew almost twice as much as that of fully OA.

- We noted last year that OA has systemically accelerated in recent years, and we think the fundamental drivers behind this remain. Publishers continue to focus on OA in the wake of various policy announcements.

- Prices have increased, and we anticipate that this will continue, although the effects of mixed-model deals on pricing dynamics have yet to become clear. Hybrid revenues realized per article published remain higher than those published in fully OA journals, and we expect this trend to continue.

- OA is increasingly delivered as part of mixed-model deals, combining read and publish elements. This may impact OA’s share of revenue in the market in the future depending upon how publishers apportion revenue from those deals to OA.

- In 2022, 49% of output was OA, accounting for just over 20% of its value. This means that on average less money changes hands for OA articles than for non-OA ones. However, OA’s share of revenue is rising proportionately faster than share of volume, so this gap continues to narrow.

Conclusion

2022 was preceded by two years of exceptional growth in open access activity and value. We saw the beginnings of a correction to offset this in 2022. The overall scholarly journals market remained flat, and growth in OA in 2022 – while strong – fell to two thirds of its previous high.

Last year, we questioned whether things would fall back quickly or slowly. They appear to have done both. The headline numbers show a significant reduction of growth compared with previous years, although the strong growth in OA masks this. When the effects of currency variations are removed, reductions in growth rates look softer – growth in OA moves from 24% to 29% (a 5-point increase), and the overall market comes back to normal growth rates.

We are likely still witnessing the effects of disruption in the wake of COVID. However, it is too soon to tell when the reduced growth rate will return to normal, and whether the 2022 figures will alter long-term trends. Our anecdotal feedback and our publisher survey suggest a reasonably positive outlook for 2023 – although not for everyone – and several factors will influence the results.

If exchange rates swing back from 2022 levels, then they could boost growth in 2023 in the same way they reduced it in 2022.

The increasing use of mixed-model deals brings with it reporting issues. Our methodology includes steps to isolate and model just the publish part of these deals when estimating OA value. As OA becomes an increasingly large part of revenues, we anticipate that higher proportions of revenue will be apportioned to OA when organizations report their figures, as they wish to best reflect the balance of their operations. Such reclassification may in turn lead to an apparent growth in OA value.

Finally, OA’s share of value (just under 20% in 2022) has always lagged behind its share of output (just over 49% in 2022). If this were to continue, then the overall value of the market will reduce as more OA is adopted. However, the gap is narrowing. In 2022, as in previous years, we saw the value of OA grow faster than its output, suggesting that yields from OA articles continue to increase. This is a critical dynamic if the value of the market is to be maintained. While publishers have been actively pursuing activities that diversify revenue and manage costs for years, their efforts to maintain value remain critical.

Our industry does not systematically report comprehensive data about market volumes or value. So, any market sizing is an approximation, and figures should be taken as approximate. Subscribers to our Data & Analytics Tool can drill into the numbers in much greater depth, including analyzing society-specific output and subscription output. Please get in touch if you want to know more.

1As our survey coverage improves, we recalculated our estimates for 2021 market values. Of particular interest in this context, we revised our estimate of the total 2021 OA market from $1.60bn to $1.65bn. Please note that market estimates by their very nature are not exact.

This article is © 2023 Delta Think, Inc. It is published under a Creative Commons Attribution-NonCommercial 4.0 International License. Please do get in touch if you want to use it in other contexts – we’re usually pretty accommodating.