News & Views: Open Access Market Sizing Update 2022

Each year, Delta Think's OA Market Sizing analyzes the value of the open access journals market. This is the revenue generated by providers or the costs incurred by buyers of content. We have seen two strong years of growth in the wake of COVID-19, as well as a shift in publishers’ focus in the wake of Plan S and exchange rate effects. Together these have compounded OA’s underlying strong growth and suggest a systemic acceleration in the growth of OA which we are now able to observe. We estimate the OA market to have accelerated ahead of our previous expectations, to around $1.6bn in 2021, growing to over $2bn in 2024 if current trends continue.

Headline findings

Updates to key industry indexes are released over the summer, and we combine these with benchmarks obtained from our publisher survey to size the market. We updated our models in 2022, which are examined in greater depth within our Open Access Data & Analytics Tool. Our revised models suggest the following headlines for market sizing:

We estimate that the OA market grew to around $1.6bn in 2021.

- The 32% increase over 2020 is significantly larger than the growth in the underlying scholarly journals market, which is typically low to mid-single digit. It is larger than expected for the OA market.

- Growth in OA will remain above that of the underlying scholarly journals market, although we anticipate both will slow in 2022 before resume underlying trends. The open access market is on target to be over $2bn in 2024.

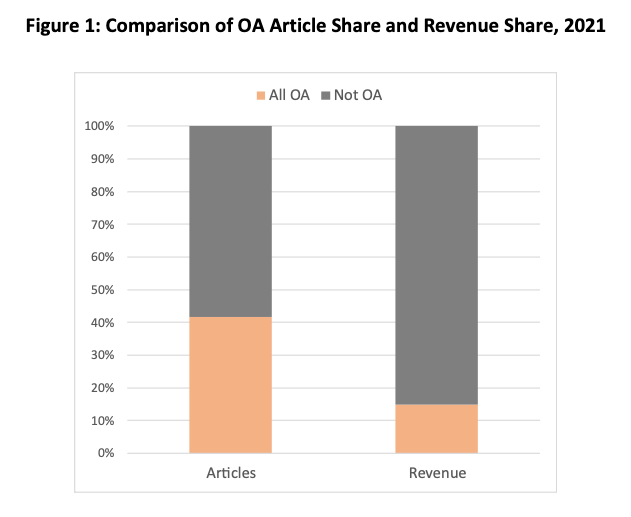

- Around 45% of all scholarly articles were published as paid-for open access in 2021, accounting for just under 15% of the total journal publishing market value. (Note that this year, we have changed our method of calculating total market, which will mean our figures for market share will increase by one or two percentage points).

- We anticipate a 2021-2024 CAGR of 13% in OA output and 12% in OA market value.

A note about our method

We aggregate data from our exclusive annual publisher survey – which now covers around two thirds of indexed global output, and just under half of everything in Crossref – and project it against patterns in the OpenAlex, Unpaywall and OpenAPC data sets to model the entire market.

The data sources change over time, so we restate our findings each year to reflect the latest data available. Even a few weeks’ difference in timing of analysis can make a significant difference in results.

We normally base our analysis on underlying trends to avoid misleading headlines resulting from short term fluctuations we see in the data. However, where there are exceptional off-trend events – as we witnessed with COVID-19 – we must incorporate them into our models. Last year we were cautious in our assumptions as we did not want to over-state what might have been a short-term blip. This year we can now see that high growth rates are persisting, so have revised our models to reflect this and be more aggressive.

Trends

The exceptional growth we saw in 2020 continued through 2021. Results from our survey and anecdotal feedback give mixed messages for 2022. Some publishers are expecting good growth to continue through 2022, albeit at slightly lower levels, while others expect a falling back and correction in 2022. The effects on underlying trends suggest that OA has systemically accelerated over the last two years, and we have revised our figures upwards accordingly.

- COVID-19 has led to a significant increase in publishing activity, showing above-average volumes in 2020 and 2021.

- Publishers have been increasingly focused on OA in the wake of Plan S. The recent OSTP policy announcement is likely to accelerate OA further.

- The large corporates have seen very strong growth in OA activity. This will serve to accelerate the growth in the value of OA: the large publishers are able to harness economies of scale and resulting efficiencies to maximize revenue.

- OA output in hybrid journals continues to be boosted more than other OA output.

- Prices have increased.

- Exchange rate fluctuations and the strong dollar have compounded the exceptional growth in publishing activity, increasing reported revenues further above long-term trends.

- We may see a slowing of growth in 2022, as activities fall back to underlying trends, but we then expect strong growth to continue. The mid-term growth is likely to be 14%-15% in both volume and value. Long-term, the growth will likely slow as OA takes increasing share and begins to saturate the market. Growth in market value may remain stronger for longer, as prices increase.

- Hybrid revenues realized per article published are higher than those published in fully OA journals. The gap appears to be fluctuating as the market is undergoing transition.

- OA is increasingly delivered as part of mixed-model deals, combining read and publish elements. We try to model just the publish part of these when estimating OA value. However, publishers may include both when stating OA figures, and we anticipate that mixed model deals will increasingly be classified as OA when organizations report their figures.

Conclusion

In normal times, we see fluctuations in growth from one year to the next around a clear underlying trend. We usually focus on the underlying trend, so we avoid misleading headlines of explosive growth followed by collapse. Last year we saw that COVID-19 had led to an increase in publishing activity. We noted that it was too soon to tell if this was a one-off blip, or whether underlying trends were shifting.

This year it has become apparent that the exceptional growth in OA was more than a single-year event. It seems that the growth in OA has accelerated, and that the underlying trends are changing. Last year the high growth rates seemed exceptional, and we did not want to overstate their effects. This year they seem normal – or at least, less abnormal – so we can be bolder in our assumptions. This has resulted in our revising our figures upwards compared with previous estimates.

The law of averages suggests that the exceptionally high growth rates will fall back to underlying trends. However, it is too soon to tell if this will be a sharp correction, or whether things will gradually slow as OA takes increasing share and simply runs out of room to grow.

The underlying drivers of policy changes and of publishers’ responses to them remain in play. The macroeconomic situation and outlook have deteriorated since last year, but it is too soon to tell what effects it will have on academic and research funding, and therefore on our market.

As always, each organization’s situation is different. We work with organizations to analyze the impact of these trends on their portfolios. Subscribers to our OADAT tool can see detailed breakdowns of fully OA, hybrid, and other revenues, along with projections the coming years, and more detailed analyses and commentary about market drivers. Please get in touch if you want to know more.

This article is © 2022 Delta Think, Inc. It is published under a Creative Commons Attribution-NonCommercial 4.0 International License. Please do get in touch if you want to use it in other contexts – we’re usually pretty accommodating.