News & Views: Is the real value of our industry shrinking?

Over the last couple of years, inflation has become big news. Unusually high inflation has affected economies and business around the world. Economists are now suggesting a better outlook for 2024. As we start the year, we ask whether inflation is relevant to scholarly publishing, and what effect it has had. Is it an outlying issue of little interest? Or does it pose a more profound challenge?

Background

When we explored the effects of currency exchange rates, we noted how many organizations report their annual revenue gains both with and without currency effects. They can be significant, so excluding them is important to understand the underlying performance of an organization or our industry.

However, it’s rare to see reports or accounts explicitly analyzing inflation. (Although underlying budgets for cost might.) Revenues are simply stated “as is” each year. When comparing year-on-year figures, management accounts do not adjust for inflation. Should they? Or are the effects not significant?

How do we work out inflation?

Inflation is calculated by observing how prices for a sample of goods change over time. Results are usually worked out per country. The most familiar measure is the Consumer Price Index (CPI), which uses a sample of goods typically bought by consumers. However, different samples may be applicable for different situations. The Higher Education (HE) Price Index, for example, looks at spending patterns of higher education institutions (in the US). It is roughly twice the rate of the CPI, as HE institutions spend on different things than consumers.

As we want to analyze our global industry, we need to take a global average. However, this too may vary. Should we look at the whole world, or just at the major economies? The latter account for the bulk of spending, so would seem more appropriate. Analyzing data from the International Monetary Fund (IMF), the CPI of only the major economies averages just under half that of the whole world.

We will therefore take global CPI as being a reasonable representation of inflation affecting our industry. It’s roughly half of HE inflation but twice that of the major economies – the two differences cancel each other out, allowing us to use a convenient, widely-available measure.

Is inflation significant?

© 2024, Delta Think Inc. All rights reserved.

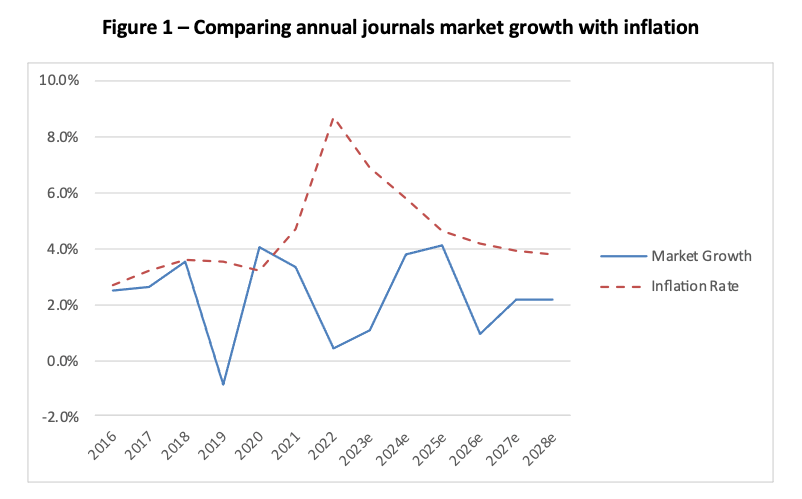

The figure above compares the annual rates of growth of the scholarly journals market with annual inflation rates (growth in prices). We can clearly see how the prices are growing at a higher rate than our market.

We can see the spike in high inflation over the last few years. 2023 saw it beginning to fall, with economists anticipating a return to long term trends in a year or two.

The underlying IMF inflation data we used suggests that, since the turn of the 21st century, inflation (the CPI) has averaged around 2% per year in developed economies. This is reflected in the mid- to long term targets of central banks, such as those in the US, the EU, and the UK.

As we noted above, however, Higher Education spending has grown faster than CPI. So the best case for our industry is that our average annual growth is neutralized by inflation. Inflation is significant.

How does this affect our value?

© 2024, Delta Think Inc. All rights reserved.

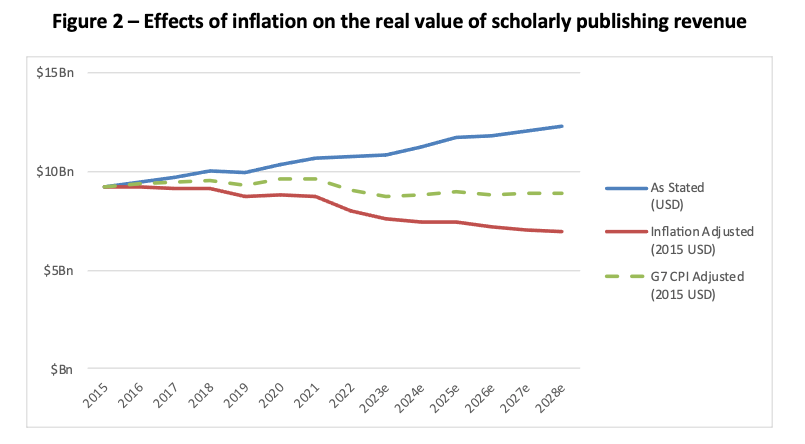

The figure above analyses what inflation means. The top (blue) line is our estimated value of the scholarly journals industry as stated each year. It is growing at an average of 2.3% per year.

However, if we adjust for inflation, the bottom (red) line shows the opposite. In real terms, our industry value is actually shrinking at 2.1% per year.

As we noted above, we took world CPI as our typical figure. But what if we use the lower CPI of the major economies? This is shown in the middle (green dotted) line. Even in this best case scenario, our industry is shrinking at 0.3% per year in real terms. For an industry which grows at an average of 2% per year or so, this is a significant amount.

So our industry appears to be shrinking in real terms – even using the most optimistic measures.

Conclusion

Inflation is not something we normally discuss in management meetings. It may be included in cost budgets, but the typical management P&L does not state this vs last year’s revenues in real terms. We usually take the figures as stated each year.

However, inflation matters.

Its huge increases in the last couple of years have made it newsworthy and significant. Economists are predicting it will fall back to longer term trends in a year or two, but they also urge caution. Early into 2024, problems of conflict and global supply chains look set to continue and perhaps worsen.

Even if current events are just outliers, in normal times inflation rates are similar to our industry growth rates. The best-case scenario is that we are barely standing still. Taking more realistic scenarios, the data suggest that our industry is in a long-term decline in real terms.

We wish our readers a happy – if cautionary – new year.

This article is © 2024 Delta Think, Inc. It is published under a Creative Commons Attribution-NonCommercial 4.0 International License. Please do get in touch if you want to use it in other contexts – we’re usually pretty accommodating.