News & Views: OSTP Memo – Modeling Market Impact

This month we look at the possible effects of the new OSTP Public Access policy on the value of the scholarly publishing market. We also suggest some ways that publishers can meet the challenges ahead.

Background

In August 2022, the US White House Office of Science and Technology Policy (OSTP) announced a new policy (“the Nelson memo”) covering the results of US federally-funded research. The previous policy (“the Holdren memo”) has been in effect since 2013, and mandated that the published results of research funded by large federal agencies is made publicly accessible after a maximum 12 month embargo. The new policy, which applies to all US agencies that fund research, specifies a zero-length embargo on articles and data, that content is machine-readable, and specific metadata directives. There are interim dates indicated for agencies to publish and implement their plans (dates vary according to the amount of federal funding the agency provides), but for all agencies, January 2026 is the latest the changes can go into effect.

The details of the policies have been discussed at length, so we will not explore the nuances further here. Our focus is to investigate if a move to zero-embargo public access may lead to falling subscription revenues, whatever the mechanism used. The hypothesis is that content will become available that is free and good enough to replace paywalled Versions of Record (VoR), and so demand for subscriptions will fall.

Scenarios

At this stage it is not possible to predict the specific approaches the various federal agencies will choose. The policy does not rule out publication in hybrid journals and the economic impact assessment discusses the notion of publication charges. Issues around licenses, manuscript types, and manuscript location, are left open as well as requirements around data.

The models below consider a general case: What might happen if “open” content in some form is good enough to replace subscriptions? And is there an upside if the newly open content were paid for in some way?

Taking our currently projected market value as a baseline, we look at how the value of the market might shift from the baseline under a few different scenarios. We explore what might happen to the market overall and what this might mean for a publisher in practice.

The effects of the policy are heavily influenced by the proportion of scholarly articles that fall under it. The OSTP’s Economic Impact Statement (issued along with its new policy) puts this proportion at between 6.7% and 9.1% of global output. Our own analysis suggests a figure between 6.6% and 7.2%. The differences depend (largely) on what is included in total scholarly output. We will take the average of their figures as a baseline for our market-wide analysis: 7.9%.

It’s important to note that the charts below must be read alongside the analysis that follows. We found that the mechanism behind the charts yields important insights for publishers who want to understand the effects for them.

Effects on Market Value

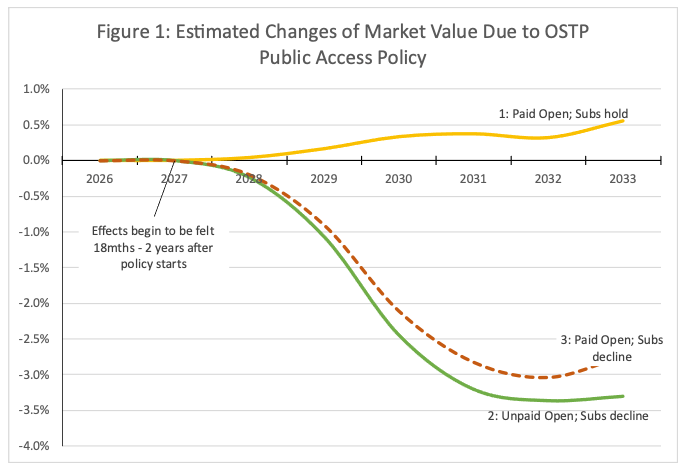

We chose three scenarios for the overall scholarly journals market, spanning our view on worst to best case, as illustrated in Figure 1. It is critical to remember that the intent of this analysis is to show the overall effect on the total market.

Source: Delta Think Analysis. © 2022 Delta Think Inc. All rights reserved.

The chart above shows the relative difference between each of three scenarios and the projected market status quo. To illustrate, -1% on the chart means that the total market value (revenue for sellers, or costs to buyers) is 1% less that might otherwise be expected. Each scenario assumes that ALL papers arising from federally funded research (the 7.9% of global output noted above) are included in the scenario. We model a four-year S-shaped transition to 100% compliance from around 18 months after the policy’s 2026 start.

- Scenario 1: Publication fees are paid for all affected papers; there is no effect on subscription revenues

- This “best case” scenario is where researchers secure funds to pay publication charges to make papers open or public access. It assumes that the content remaining under the subscription models is sufficient to maintain subscription revenues.

- This will lead to a small increase in overall market value, as the new OSTP policy drives bolt-on publication fees.

- Scenario 2: Publication fees are not paid on affected papers; subscription revenues fall because of the zero embargo

- This scenario (aka the “worst case” for publishers) assumes that publicly available papers – Author’s Accepted Manuscript (AAM) or Version of Record (VoR) – are deemed good enough. Publishers must reduce subscription prices to reflect the increased proportion of content available free of charge.

- This will lead to a decrease in total market value of around 3.5%.

- Scenario 3: All affected papers are included in subscription fees, but subscription revenues fall to offset the openly available content

- This combines the upside of Scenario 1 (new publication fees) with the downside of Scenario 2 (decline in subs).

- Here, there is still a net reduction in market value of around 3%. The lower publication charges are outweighed by the loss of the higher priced subscription charges.

Effects on Publishers

Specific publishers will find their situation different to the broad market averages. One difference will be the share of their papers arising from US federally funded research. Delta Think has worked with publishers, predominantly US-based, where federally funded research accounts for 30-50% of their publications. A second difference is the size of the gap between the lower revenue generated per open access article, and the higher revenue generated per subscription access article. For many publishers, the difference is less than the market average. So as the balance of their publication output shifts towards OA, their subscription revenues won’t fall as quickly as market averages.

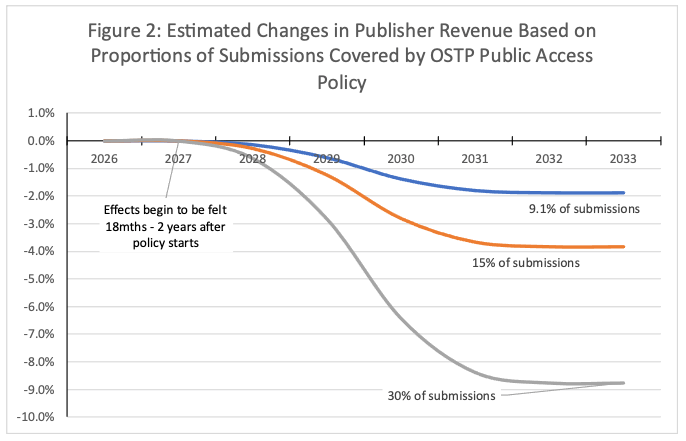

We ran three further scenarios looking at different proportions of papers affected. We based this on aggregated revenue per article data from our annual publisher survey. Could the smaller differences between OA and subscription revenues in our sample mitigate the effects of the larger proportions of papers affected?

Source: Delta Think Analysis. © 2022 Delta Think Inc. All rights reserved.

The chart above shows additional variations of Scenario 3 from Figure 1, assuming ALL articles affected by the new OSTP policy attract publication fees, but that subscription revenues decline to offset them. The variable is the proportion of papers affected.

- The new OSTP policy affects 9.1% of the publisher’s output.

- This is the high end of the OSTP’s estimate of the US government-funded share of all scholarly output. It could be a reality for a large publisher, with an international author base.

- It leads to a reduction in the publisher’s revenue of around 2%.

- The new OSTP policy affects 15% of the publisher’s output.

- Publishers with a tilt towards the US may find themselves dealing with this scenario.

- The higher proportion of affected papers leads to higher reductions in revenue, of just under 4%.

- The new OSTP policy affects 30% of the publisher’s output.

- This could be a reality for a society publisher that relies heavily on US government-funded submissions.

- The high proportion of affected papers leads to higher reductions in revenue, of just under 9%.

Other Factors

A few other important drivers are not immediately obvious from the charts:

- The US’s share of global output is declining slowly: 1 percentage point or less per year, depending on the data sources used. Therefore, the effects of the OSTP policy reduce over time. (Which is why the charts head back towards the horizontal axis.)

- Pricing policies are key. Understanding reduction in market value could help publishers to set price increases and help funders and buyers to understand likely cost implications. Publication fees can be optimized across a portfolio of journals and subscription prices raised further to offset softening revenues.

- As the difference in revenues per article between OA and subscription narrows, then the effects become less profound. We have long noted that publication charges are likely to rise to achieve parity with subscriptions.

- The models show revenue changes compounded over time. They don’t show annual revenue increases generated by increasing APC prices.

Conclusion

William Gibson’s famous quote has rarely been more apt: “The future is already here – it's just not evenly distributed.” The market-wide effects of the OSTP policy may be modest at first glance, but the effects felt in practice will depend hugely on each publisher’s own circumstances.

The fundamental question for most, is at what threshold might subscriptions collapse? Or not? Could 10% of a subscription journal’s content (rounding the high OSTP number up) lead to mass subscription cancellation? What about 15% (if we then layer in Plan S)? Or 30% (which may be the reality for many societies)? Meanwhile, large publishers, with a global footprint of authors, may see fewer of their submissions affected. They may find modest price rises enough to counter small ill effects, especially if they already have well-developed open access portfolios. And born-open publishers, will, of course, see this as an opportunity. Your mileage may vary.

The OSTP’s mileage may vary too. Each agency will decide its specific requirements. Unlike Plan S, there is no mention of requirements related to Hybrid or license types or manuscript types. There is mention of metadata, which feeds speculation about Green. Researchers simply don’t want to scour the web for secondary versions at present. But could subscription revenues decline if the changes mean that “free and good enough” becomes readily discoverable through better search engines or aggregation services? Or would subscriptions be affected at all if AAMs cover agency policies, but researchers continue to prefer the VoR?

The answers lie in analyzing the specifics for your organization and planning a response. We chose a spread of scenarios here to illustrate what might happen for a range of different organizations. In practice, we work with publishers on a regular basis to tailor models to their situation and analyze the factors affecting them. Every publisher is different, and on close examination of their situation, they may find that things are not as bad as they may seem initially. Please contact Delta Think if you are interested in a custom analysis.

This article is © 2022 Delta Think, Inc. It is published under a Creative Commons Attribution-NonCommercial 4.0 International License. Please do get in touch if you want to use it in other contexts – we’re usually pretty accommodating.