News & Views: Open Access Loses Share – Market Sizing 2024 Sneak Peek

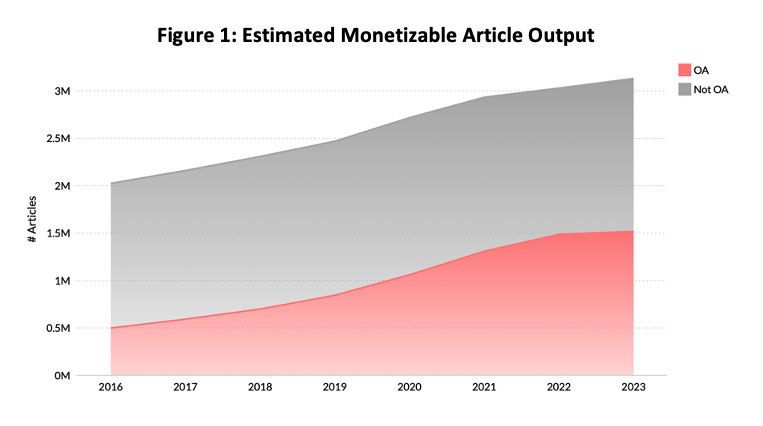

Each year, Delta Think analyzes the volume and value of the scholarly journals market. This month, we present preliminary results about volumes of journal output ahead of our full sizing results later in the year. Total publication volumes continue to increase across the whole market, and for Open Access. However, Open Access (OA) lost share for the first time in 2023 likely because of problems experienced by the OA publishers in 2022 and 2023. The pace of growth of overall output is falling back to long-term trends after the post-COVID spike.

Headline findings

Our preliminary results for full year 2023 are as follows. Subscribers to our Publishing Data & Analytics Tool can explore these in greater detail, including separating out fully OA and hybrid numbers.

Source: OpenAlex, Delta Think annual publisher survey, Delta Think analysis. © 2024, Delta Think Inc. All rights reserved.

Volumes of articles continue to increase, but 2023 saw some important underlying changes.

- Total article output grew by 3.4% compared to the previous year.

- OA article output grew by 2.1%.

- Based on underlying trends, we estimate a 2023-2025 CAGR (average growth each year) in OA output of around 10%.

- For the first time, growth in OA fell below that of the underlying scholarly journals market.

- It is too soon to tell for sure if growth will recover. However, as discussed below, we anticipate growth in OA will pick up again this year, albeit at slightly lower rates than we have seen over the last few years.

Source: OpenAlex, Delta Think annual publisher survey, Delta Think analysis. © 2024, Delta Think Inc. All rights reserved.

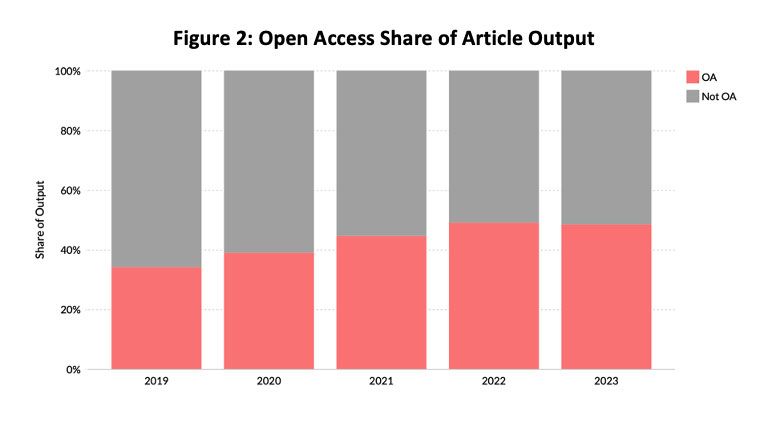

Even though total OA output grew in 2023, it lost share as total output grew faster.

- OA has historically taken share. We estimate around 45% of paid-for scholarly articles were published OA in 2021, growing to just around 49% in 2022.

- In 2023, this fell back to around 48%.

- Although the decline in share is small, it’s significant. Normally OA gains share by a few percentage points per year. For the first time, preliminary data analysis results show it has lost share. This represents a reversal of long-term observations.

- We should note, however, that the underlying long-term trend is that of continuing growth in OA share. It is too soon to tell if the reversal is permanent, or whether it will pick up again.

- Last year we anticipated that OA would pass the 50% mark in 2023. This turned out not to be the case, so it does not yet account for the majority of monetizable output.

A note about our method

Each year we survey major publishers. We do not yet have all the results for this year’s survey, but, as ever, we are very grateful to the organizations that participate. We anonymize and aggregate the survey data to inform our estimates. At the time of writing, we have enough results to estimate volumes of output. Our yearly update about market value will follow soon.

Our market estimates focus on the subset of research publications for which money is likely to be paid, either to read or to publish. We focus on underlying trends to inform strategic decision-making, and remove short-term fluctuations which make for interesting headlines, but offer little strategic insight. Our definition of “Open Access” excludes public access (“Bronze”) and repository-only (“Green”) content.

Trends

Last year, we anticipated a slow-down in growth in 2023 as the industry corrected to long-term trends. Events since have exacerbated the slow-down. For the first time, underlying drivers of the market may be showing signs of weakness.

- COVID-19 led to a significant increase in publishing activity, resulting in above-average volumes and growth rates in 2020 and 2021. 2022 saw lower growth in output of all types compared with the previous year. Our anecdotal evidence at the time suggested a strong 2023.

- The problems experienced by OA publishers in 2023 – perceived quality problems, special editions, shifts and uncertainty around funder mandates, and loss of Journal Impact Factors – led to a significant decline in their output in 2023. We expect this may continue into 2024.

- Large and more established publishers have seen their OA output continue to grow. They have likely benefited from authors moving away from fully OA publishers. The data suggest a mix of authors changing their choice of publisher for OA content and moving away from OA entirely. Thus, we see the total output growing while OA loses share.

- A move away from fully OA publishers has also led to a slight increase in hybrid OA. Growth in hybrid is experiencing an uplift over long-term trends.

- It’s too soon to tell if there is a systemic slow-down in OA growth entirely, or whether growth in OA output (and in OA publishers) will return to its historically high levels. The outlook for 2024 appears mixed, and we anticipate that growth in OA share will continue to face headwinds in 2024.

Conclusion

Total scholarly journal output has moved back to long-term trends following previous corrections to the post-COVID upswing. Open Access output, however, was held back by issues experienced by OA publishers.

Quality problems due to paper mills and the loss of JIFs for fully OA journals have been well-rehearsed elsewhere. Although affecting a subset of journals, the problems have led to a wider move away from journals published by fully OA publishers. The data suggest a mix of authors choosing alternative venues for their OA papers or rejecting OA completely. Large and more established publishers have seen continued growth in OA, so are likely picking up the slack.

It is worth noting that the fully OA publishers still account for around one fifth of the market’s output. Even with declining output or slowing growth, they will continue to account for a significant share of the market.

Historically, the high growth rates in fully OA publishers’ journal output have fueled the high growth rates in overall OA output. With this fuel running out, we see the whole OA growth engine sputtering. Output in hybrid journals has benefited (whether open or not), and we saw an increase in public access output (aka Bronze) after years of slow decline. Non-OA (subscription) output has also seen a boost. Subscribers to our Publishing Data & Analytics Tool can explore these nuances in more detail; please get in touch if you are interested in finding out more.

The big question is now whether OA growth rates will pick up again, or whether we are seeing some sort of plateauing. Might OA even start losing share?

There are a couple of parallels here. One is that the large Megajournals found their output falling back after initial explosive growth, as the realities of scaling bit them. Could we be seeing something similar affecting the overall OA market?

The other parallel is the stock market. Problems affected relatively small numbers of fully OA journals, but their publishers experienced declines across their portfolios. When a few prominent companies experience problems, then it can cause wider stock market selloffs in the same way. However, after such corrections the market inevitably bounces back. Will this happen to OA output? Only time will tell.

Our industry does not systematically report comprehensive data about market volumes or value. So, any market sizing is an approximation, and figures should be taken as approximate. Subscribers to our Data & Analytics Tool can drill into the numbers in much greater depth, including analyzing society-specific output and subscription output. Please get in touch if you want to know more.

This article is © 2024 Delta Think, Inc. It is published under a Creative Commons Attribution-NonCommercial 4.0 International License. Please do get in touch if you want to use it in other contexts – we’re usually pretty accommodating.