The open access market is fragmented. Different approaches at scale are being explored by stakeholders, from wholesale flipping to offsetting deals, from price caps to restrictions on using hybrid journals. Meanwhile, the real adoption of open access has been slow, reaching just 21% of output in 16 years and accounting for only 4-6% of scholarly journal publishing revenue.

The market size for scholarly journals represents profit for some and cost for others. Below we look at market size (in terms of potential growth or reduction) as a measure of the effects of various approaches for all stakeholders.

Understanding the major drivers

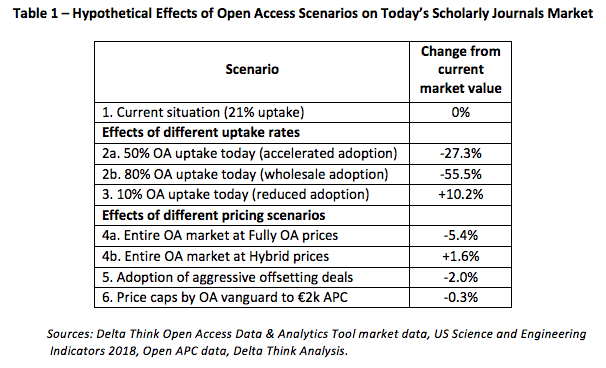

Table 1 models some hypothetical scenarios, showing what could happen if we flipped to some long-term changes today. For example, what happens if most of today’s output were monetized via open access rather than subscription routes? By comparing like-for-like at today’s rates, we can see which scenarios might have the most or least impact.

All scenarios use 2016 data as a baseline, as this is the most recent year for which we have reliable data across all the data sets used. For each scenario, we have modelled the change in total scholarly journal market value from its current level.

- The Current Situation shows no change, as it is our reference.

- If we currently had a higher proportion of open access uptake, we would see a reduction in overall market value as revenue per open access article is less than that under subscription model. Scenarios 2a and 2b show variations of levels of uptake.

- …and lower than current OA uptake would result in higher market value.

- A large move away from hybrid journals would affect the balance between hybrid and fully open access. We modelled a total flip to hybrid (4a) and to fully OA (4b) at current prices. The results reflect the difference in pricing between the two. Although 70% of journals offer a hybrid option, and some institutions see high proportions of hybrid use, the number of OA articles published in hybrid journals accounts for a small proportion of the market overall. An exclusively hybrid world would therefore add only marginal total revenue.

- If sections of the market flipped to aggressive offsetting deals, where subscription revenues were reduced to cover OA income, the effects are modest. This reflects OA’s small market share. We estimated the scope of these deals, by modelling the proportions of OA adoption in territories which have championed OA adoption combined with our estimates of market share of big deals.

- A €2,000 ($2,200 at 2016 rates) price cap would have a modest reduction, if we model it across the likely regions of implementation (those of high adoption with centralized infrastructure and OA advocacy), taking a view on proportion of uptake in these and other areas.

In modelling scenarios, the proportion of OA uptake has the most profound effect on the numbers, with some of the headline-grabbing systemic business model shifts having a much more modest effect.

Projection over time

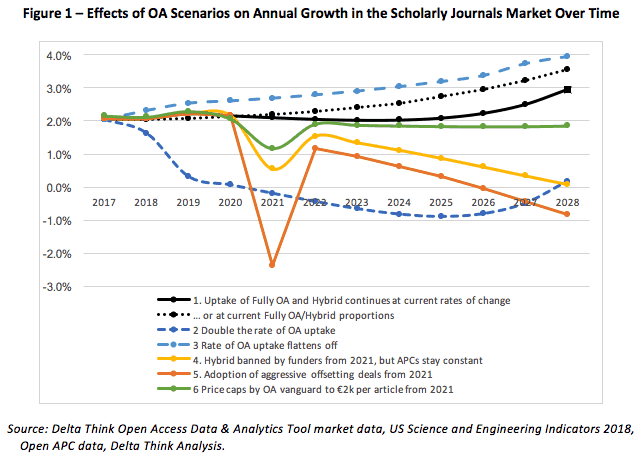

The results of these scenarios over time are shown in the chart below. The models become more nuanced, as they account for changes in uptake, pricing, and proportions of business models over time.

They show annual market growth, as:

- The baseline scenario assumes the current rates of change in pricing and uptake continue. This includes a constant 5% annual growth in scholarly output, with OA growing at current rates (from 21% now to 44% share of output in 10 years’ time). The first baseline shown (solid black line) assumes hybrid continues to take share at current rates, which leads to a baseline of 2% annual market revenue growth – the current long term growth in this market. The uptick in later years occurs due to the multiplier effect of higher OA share and higher APCs. However, if the share of hybrid stayed as it is now (dotted black line), long term market growth would increase by 0.5% percentage points per year, as fully OA prices are currently growing faster than hybrid.

- If OA uptake doubled in pace, we see a profound reduction in market growth, as OA’s lower prices take over. This model projects 50% OA uptake by 2024 and 80% uptake by 2028. Note, however, how overall growth starts to increase as prices increase. So, if prices increased more quickly than at present, the market would grow faster.

- Conversely, a slowing down in OA adoption – and we have seen its growth of share slow in recent years – would increase overall market growth. This model assumes growth in OA market share flattens off to around one third in 10 years.

- If funders banned hybrid, and average fully OA prices remained constant, we would first see a short term reduction in growth, followed by a long time decline in growth rate. The point of this model is to show the underlying drivers and worst-case effects, which are driven purely by pricing differences between fully OA and hybrid. In practice, everything would not flip in one year, and we would most likely see fully OA prices rise to make up the shortfall. The real-world outcome is most likely no change in this scenario.

- Adoption of widespread offsetting deals has the most profound long-term effects on market growth. Our snapshot (Table 1) suggested the effects would be modest today, but as open access takes share over time, the reductions of core subscription revenues become more profound. Again, the flip would not happen in one year (as illustrated), so the initial dip would be shallower and last longer. The only counter would be to increase subscription prices, but in an offsetting-driven world coupled with demands for aggressive price management, this might prove challenging.

- Modelling price caps in regions with strong OA agendas shows modest effects over time. It is likely this would be implemented at scale as a result of funder policy changes, so we would see a quick transition, after which growth would steady out.

Conclusion

The point of modelling these scenarios is not to arrive at exact numbers, but to understand the relative effects of different drivers. This exercise enables us to get a sense of how policy decisions might play out.

Results can be counter-intuitive. For example, while many studies suggest hybrid prices are higher than fully OA prices, increasing the proportion of hybrid would lead to lower overall costs compared with no change over the current balance. Likewise, simply banning the use of hybrid journals would most likely not reduce publication costs. Publishers would simply put other prices up. Mandated price caps would have limited effect as they would be localised (and if previously cheap prices rose to meet the cap, then overall costs would rise).

The most radical changes could come from wholesale moves to offset big deals. However even if they happened at scale over a short period of time (an unlikely scenario), their worst-case effects would be to slow overall market growth to just below zero in the long term. (Although the effects may be more profound for the fewer, larger publishers offering big deals. For those publishers, the smallest changes to modest organic growth rates can become disruptive.)

The real story lies in data that’s not shown but which came out in all our models. Revenue per article is declining over time anyway. MPDL’s noted white paper suggested €3,800 – €5,000 per article is being spent. Our data suggest the lower end of that range is being spent at present, but will fall to about €2,500 ($2,800) per article in 10 years’ time: a clear convergence to MPDL’s suggested €2,000. Average publishing prices are rising more slowly than scholarly output, so lower unit prices are a matter of when and not if.

Even with quite radical assumptions, none of our models suggested massive systemic cost reductions, or a record-industry like collapse of revenues (due to open access, at least). Whether this is disappointing or reassuring, it is an inevitable consequence of ever-rising scholarly output and a conservative, fragmented ecosystem.

TOP HEADLINES

Elsevier: Preprints with The Lancet launches on SSRN – June 28, 2018

“Elsevier’s world leading preprint server and early stage research platform, has announced the launch of ‘Preprints with The Lancet’ – a new preprint series for sharing early stage health and medical research. The collaboration brings together SSRN with The Lancet as part of a six-month pilot to assess whether the health and medical community are ready for this form of early research sharing.”

Simba Report: Open Access Sales Exceed Expectations – June 26, 2018

“Once viewed as a threat by traditional journal publishers, the global push for open access to research papers has delivered a fast-growing revenue stream that will continue to scale upwards—this according to the most recent report from media and publishing intelligence firm Simba Information.”

Peer review: eLife trials a new approach – June 26, 2018

“eLife authors are being invited to take part in a trial in which they decide how to respond to the issues raised during peer review.”

Will Europe Lead a Global Flip to Open Access? – By Roger Schonfeld – June 26, 2018

“The emergent problem is straightforward: there appears to be no realistic path forward that achieves the 2020 OA targets without resulting in substantial revenue reductions for existing publishers. Will Europe miss its OA target? Or will publishers miss their revenue targets?”

All Change: Preprints Count – less support for Hybrids – June 25, 2018

“A statement has been released by the European Commission stating changes for the implementation of Open Science in Horizon Europe. In particular, publication costs will only be eligible for purely open access journals, i.e. not for publishing in hybrid journals, and depositing a preprint will satisfy the open access mandate obligations.”

Time to Check Out of the Hybrid Hotel? – By Rob Johnson – June 25, 2018

“Heralded by many as a transition mechanism to full open access (OA), hybrid OA has shown impressive growth in recent years, but questions are now being asked of its sustainability. Rob Johnson considers the future prospects for hybrid publishing and argues that publishers need to get serious about offsetting arrangements, if recent progress is to continue.”

University of California: Championing Change in Journal Negotiations – June 21, 2018

“Our goal, simply put, is to responsibly transition funding for journal subscriptions toward funding for open dissemination. As we approach major journal negotiations for 2019, the UC system will be guided by the principles and goals outlined here in negotiating agreements with publishers.”

FAO launches Open Access for all publications – June 18, 2018

“The Food and Agriculture Organisation of the United Nations (FAO) will implement an Open Access policy, enabling maximal reach and ease of use for FAO knowledge products…In concrete terms, FAO will apply a Creative Commons 3.0 IGO license to all eligible publications and documents published on its Web site.”

MIT and Royal Society of Chemistry Sign First North American “Read and Publish” Agreement for Scholarly Articles – June 14, 2018

“The MIT Libraries and the Royal Society of Chemistry have signed a groundbreaking license agreement that incorporates elements of a traditional subscription purchase and open access to scholarly articles. The experimental two-year agreement is seen as an important step on the path toward making more research freely and openly available to the world.”

North American Universities Increasingly Cancel Publisher Packages – June 11, 2018

“A growing number of libraries are unbundling their subscriptions to the full suite of publishers’ journals, opting for limited titles to save on costs.”

COAR and DuraSpace enter into partnership – June 6, 2018

“By working together, DuraSpace and COAR will leverage their unique strengths and communities to pursue our common goals. In particular, the partnership will focus on building capacity in the repository community by delivering and participating in training events, with a special emphasis on developing countries; and promoting the value of open repositories with other communities internationally.”

Preprints growth rate ten times higher than journal articles – May 31, 2018

“The Crossref graph of the research enterprise is growing at an impressive rate of 2.5 million records a month – scholarly communications of all stripes and sizes. Preprints are one of the fastest growing types of content.”

OA JOURNAL LAUNCHES

June 12, 2018 | BMC Biomedical Engineering: the BMC series expands into engineering | “BioMed Central is excited to announce that our first engineering journal, BMC Biomedical Engineering, is now open for submissions. This is one among many journals to come in the next years aiming to expand the scope of the BMC series beyond biology and medicine and into engineering.” |

June 12, 2018 | Developmental Epigenetics: New Frontiers in Cell and Developmental Biology section | “The new section focuses on epigenetic processes and mechanisms involved in programming developmental trajectories, as well as the consequences of unprogrammed rewiring of the epigenetic network in disease.” |

June 4, 2018 | “A new journal in mathematics was launched by Timothy Gowers and Dan Kral. The journal, called ‘Advances in Combinatorics’, is an overlay journal, built entirely on articles contained in the arXiv repository. It is free to read and will not charge authors to publish.” |