News & Views: Plan S Effects 2021 – Part 2, Market Value

This month we look at the possible effects of Plan S on the value of the scholarly publishing market. This follows last month’s analysis of the effect Plan S might have on the volumes of output in the scholarly publishing market. We also examine the potential effects of the UKRI adopting Plan S policies.

Background

In September 2018, 11 national European funding agencies announced cOAlition S, their “initiative to make full and immediate Open Access to research publications a reality.” Implementation was originally planned from 2020, but in practice came into effect for funding starting in January 2021. The initiative – called Plan S – is aimed at accelerating a move away from subscription to fully OA journals. However, it allows for interim, hybrid “transformative” arrangements.

Last month, working with the Institute for Scientific Information (ISI)™ at Clarivate, we analyzed Web of Science™ data to determine the proportions of scholarly papers affected by Plan S funders. For example, we found that cOAlition S funders accounted for around 5.2% of all publications that would fall under Plan S policy if it had been in place during 2020. The proportion of such papers in hybrid journals is over twice that of the average (12.7%). We also looked at what might happen if Plan S principles were adopted by the UK’s UKRI.

Scenarios

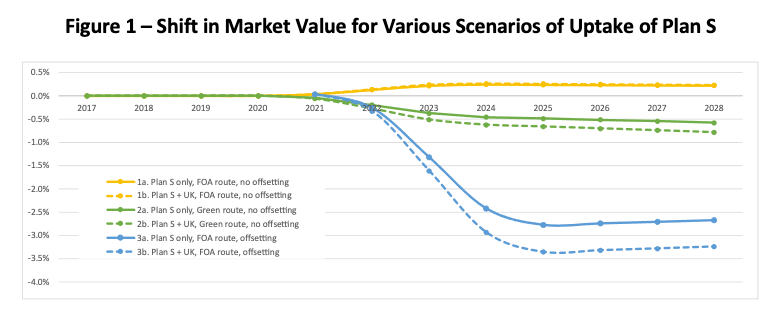

By combining the data on article volumes with our market sizing models, we can look at how the value of the market might shift. We take our currently projected market value as a baseline, and then compare how it might change under a few scenarios. For the sake of analysis, we compared what might happen if ALL authors chose one Plan S compliance route over another. In practice there will be a mix, and so the reality is likely to land somewhere between our two extremes. The chart below shows the results.

Source: InCites, Clarivate, Delta Think Analysis. © 2021 Delta Think Inc. All rights reserved.

Plan S has three routes for compliance. The transformative arrangements routes are due to cease at the end of 2024. So, we modelled what might happen as we transition to either of the other two compliance routes over that time period, covering three scenarios.

We first looked at the cases where publishers are able to maintain subscription prices, even if the Plan S-funded articles move to different journals or business models.

- Compliance via fully OA journals

- Plan S could lead to a slight lift in market value of just under 0.25% in the long term. Plan S articles add incremental revenues by boosting volumes in fully OA journals. Meanwhile with a mild drop in volumes from subscription journals, publishers are able to maintain their prices.

- The UK’s UKRI is currently considering its position on OA. If the UKRI were to adopt Plan S principles, then it will make little difference to the market if the fully OA compliance route was followed.

- Compliance via repositories

- Plan S could lead to a slight fall in market value of just under 0.6% in the long term. This is driven by lost hybrid OA revenue, as authors opt for subscription journals instead.

- If the UKRI were to adopt Plan S principles, then the long-term fall in market value would be just under 0.8%. This is another third or so compared with Plan S on its own. The UK’s current policies have driven significant hybrid uptake. If the value of these APCs is lost, it will have a noticeable effect.

We also looked at the cases where publishers must offset subscription prices against increased OA volumes.

- Compliance via fully OA journals

- Plan S could lead to a fall in market value of around 2.8%. Subscription journals generate more revenues per article than their OA counterparts. Therefore, a reduction in subscription prices for a given volume of articles will be greater than the gains made from APCs. This adjustment will happen once. Then, as OA output is growing faster than the market as a whole, it will start to drive a very mild increase in market value.

- If the UKRI were to adopt Plan S principles, then the long-term fall in market value would be just under 3.4%, or around 20% more than Plan S alone. The same dynamics apply as for Plan S alone.

Combining the repository route and offsetting does not apply here – submitting more subscription articles means there is nothing to offset. We have not modelled the effects of the required zero length embargoes.

Conclusion

If the scholarly journals market grows at around 2%-3% per year, even small shifts become significant. For example, if anticipated market growth fell by 0.5%, consistent with our modest scenarios, projected market growth would decline by 14%. When compounded over a few years, the equivalent of an entire year’s growth could be lost in our mild scenarios; several years could be lost in our more extreme ones.

The average effects are not evenly distributed. They may be more profound for specific publishers. Those with a greater proportion of Plan S-funded papers than average and those with high-impact journals may see much greater variations. They may find it hard to maintain subscription prices in the face of significant shifts in the balance of their content.

All our scenarios suggest we are seeing a realignment of value across the marketplace. Is the market on the verge of imminent collapse? Probably not. But how deeply the value realignment cuts will depend on how publishers, funders, researchers, and universities react. Proactive analysis and scenario planning now is the only way for all industry stakeholders to ensure they are considering their options and acting accordingly.

We recommend organizations contact us if they would like to see models specific for them.

We would like to thank Clarivate for supplying data from its InCites product.

This article is © 2021 Delta Think, Inc. It is published under a Creative Commons Attribution-NonCommercial 4.0 International License. Please do get in touch if you want to use it in other contexts – we’re usually pretty accommodating.